On 10 May 2023, TM filed a Bursa Announcement to notify that the longstop date to fulfil all conditions precedent in the Share Subscription Agreement (SSA) for the subscription of a 20% equity stake in Digital Nasional Berhad (DNB) had lapsed. Consequently, TM issued a termination notice to DNB, effective immediately.

Nonetheless, TM looks forward to the next process and discussion with the Government and the industry on 5G participation across Phase 1 (towards 80% service coverage by DNB) and Phase 2 (shift to two networks), as announced by the Government on 3 May 2023. TM is committed to continue playing an active role in the 5G implementation, leveraging its nationwide fibre infrastructure, extensive digital platforms (data centre, edge nodes) and rollout experience.

In the meantime, TM customers of Unifi Mobile and TM One will continue to enjoy 5G services and solutions, as the 5G wholesale Access Agreement remains in place.

TM is committed to serve as the nation’s trusted partner to grow Malaysia’s overall connectivity and digital ecosystem, including 5G. We are committed to shaping a Digital Malaysia through technology that empowers communities, businesses and Government.

YOU MAY ALSO LIKE

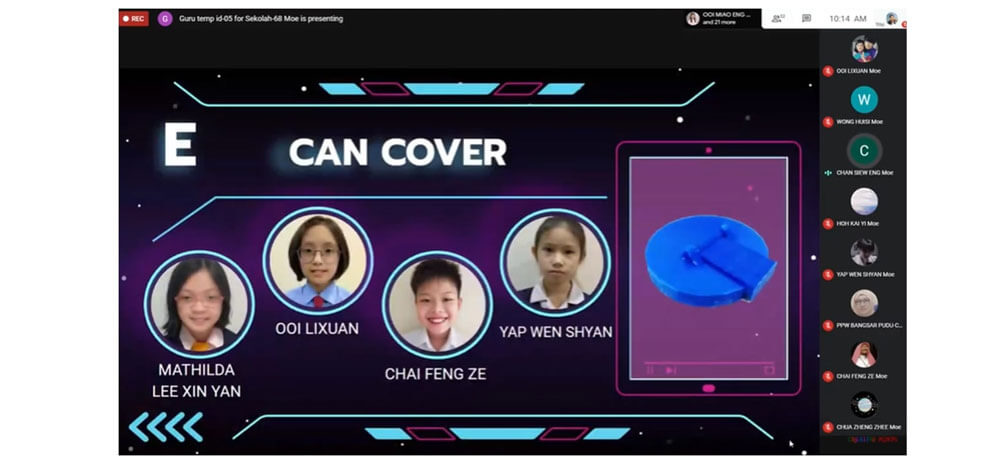

TM Future Skills Programme continues with a project based learning e-showcase event

Two (2) schools participated in E-Showcase PBL-TM Future Skills 2020, the highlight of a 3-month online learning programme for teachers and students of the schools Telekom Malaysia Berhad (TM) continues its efforts to equip the younger generation with Industrial Revolution 4.0 (IR4.0)-centric knowledge through initiatives under its TM Future Skills programme. Most recently, students from Sekolah Jenis Kebangsaan Cina (SJKC) Jalan Davidson, Kuala Lumpur and SJKC Tsun Jin, Kuala Lumpur demonstrated their talents in 3D programming and printing skills in a two (2)-days online event held in collaboration with Bangsar / Pudu District Education Office (PPDBP). The event, titled E-Showcase Project Based Learning (PBL)-TM Future Skills 2020, saw the participation of 60 teachers and students from both schools. The students showcased their 3D innovation projects and at the same time, shared and displayed their knowledge and skills in Science, Technology, Engineering and Mathematics (STEM) subjects. Izlyn Ramli, Vice President, Group Brand and Communication, TM, said: “We are delighted with the schools’ acceptance and active participation in the TM Future Skills Programme. Our Corporate Social Responsibility (CSR) programmes under the education pillar are always aimed at supporting the nation’s education system towards preparing not only the students, but also the teachers and society at large, with IR4.0 skills. We hope this programme will help to enhance the students' future skills and increase their interest in STEM subjects. This befits our role as a responsible nation builder where we will continue to serve and enable Digital Malaysia through innovative and inclusive digital solutions.” Teah Lay Theng, Headmistress of SJKC Jalan Davidson, said: “The PBL approach was chosen for the programme as it can bring out the most from the students in terms of innovation and creativity. The use of digital equipment is also able to improve the digital skills and competencies of our students in producing the innovations.” Meanwhile, Ng Mooi Hong, Headmistress of SJKC Tsun Jin, said: “In the current pandemic environment, teachers need to be creative in imparting knowledge and running the programmes that can develop the potential of our students. With this programme, we hope to inoculate the interest, highlight the potentials and empower the students with STEM subjects.” The E-Showcase PBL-TM Future Skills 2020 was the highlight of three (3) months long online learning programme for teachers and students of the two (2) schools. Throughout the programme, the teachers and students from both schools learned about digital technology in TM 3Ducation – the 3D printing module to be implemented in their PBL. Due to the ongoing pandemic Covid-19, TM’s strategic partner for TM Future Skills, Creative Minds, conducted the training sessions for all the teachers and students, including parents, through an online platform. Not being in class physically following the closure of schools nationwide has also not deterred these young innovators. They persevered in conducting research and continued to experiment and collaborated with each other virtually for the past 3 months. At the same time, School Improvement Specialist Coach (SISC+) from PPDBP closely supervised the activities and monitored the progress of the participants. Streamed live via YouTube, the E-Showcase garnered more than 6,000 viewers throughout the 2-day event and the channel has cumulated more than 7,800 views to date. The panel of judges for the E-Showcase consisted of SISC+ from PPDBP and led by Izad Ismail, Head of Corporate Responsibility, TM. TM Future Skills programme is an initiative that aims to empower students by equipping them and teachers with IR4.0-centric kits and knowledge, such as the TM 3Ducation – 3D printing module and the TM Nano Maker, a real-time data logging tool for STEM. This is to prepare them to be part of a digital-ready community and future-proof workforce which has always been one of the pillars under TM’s Digital Malaysia aspiration. As a key enabler of this, TM has always been an avid supporter of innovation and technology in Education. Through programmes like TM Future Skills, the Company endeavours to empower the leaders of tomorrow with relevant skills in innovation and technology towards serving a more digital society and lifestyle, digital businesses and industry verticals, as well as digital Government. For more information on the Company's other Corporate Responsibility initiatives, visit www.tm.com.my.

TM Demonstrates Commitment to Long-term Value Creation and Nation-Building at its 40th AGM

KUALA LUMPUR, 27 May 2025 – Telekom Malaysia Berhad (“TM” or “the Group”) demonstrated its firm commitment to delivering long-term value creation while enabling inclusive digital progress for the nation. TM returned approximately RM1.5 billion in value, benefiting various stakeholders through dividends and contributions that supported national socioeconomic progress. At the same time, TM prioritised strategic investments in business growth, community development, social impact programmes, and employee development, further generating a multiplier impact on the broader national economy. These efforts reflect TM’s focus on delivering sustainable returns to shareholders while staying true to its core purpose of creating value for all stakeholders as a nation-builder. “At TM, we see ourselves as facilitators of national progress, driving inclusive digital transformation that empowers enterprises, enriches communities and bolsters economic resilience. We are fully aligned with this vision - staying agile, expanding our capabilities and setting new benchmarks in service excellence to ensure that Malaysia remains at the forefront of the digital economy. This is what it means to be a world-class organisation,” said Dato’ Zainal Abidin Putih, Chairman of TM. This was underscored at TM’s 40th Annual General Meeting (AGM) held today at Multi Purpose Hall, Menara TM, Kuala Lumpur, where all 14 resolutions tabled were duly passed by shareholders. The meeting was chaired by Dato’ Zainal Abidin Putih, with the Board of Directors and Amar Huzaimi Md Deris, Managing Director and Group Chief Executive Officer, in attendance. Empowering Communities through Digital Access and Inclusion Beyond profits, TM is committed to driving digital inclusivity for all including nurturing future-ready talent, empowering communities, and expanding inclusive digital access across the country. For example, TM is expanding its digitalisation efforts and community-building in Pulau Tioman, starting with Kampung Mukut. Similar programmes are being considered for other islands already connected through TM’s submarine cable infrastructure. TM is also committed to develop schools on these islands, with a focus on nurturing youth through STEM education and digital exposure. “Our goal is to build digital ecosystems that empower local communities, helping them shift from traditional livelihoods to sustainable, future-ready opportunities,” said Amar. These efforts are further supported by the TM Future Skills (TMFS) School Programme, where TM has created three ‘nucleus’ schools designed as regional hubs for innovation via the TMFS Digital Hub. TM also plans to onboard 25 new schools in 2025. Meanwhile, Yayasan TM has launched the Yayasan TM TVET Madani initiative to enhance the skill sets and employability of TVET graduates, while its education arm, Multimedia University (MMU) collaborates with schools nationwide to provide early exposure to STEM subjects through workshops and career guidance. At the same time, TM continues to provide tailored digital solutions to more than 400,000 MSMEs nationwide, helping them grow and thrive in the digital economy. Under its talent development agenda, TM has contributed RM641 million to date to nurture close to 19,000 talents, many of whom now contribute to the broader digital economy and are part of the leadership in corporate organisations and national institutions. “This is how we demonstrate that success and achieving higher purpose can go hand in hand,” said Amar. Championing Sustainability and Responsible Growth Sustainability remains core to TM’s long-term strategy. The Group’s Sustainability Framework, introduced in 2024, is built on two key objectives: enabling sustainable growth for customers and communities, and ensuring resilience across the business and value chain. In its data centre operation, TM sources 50% of its data centre energy from renewable resources and implements water harvesting and recycling systems for water conservation. TM is also targeting global benchmarks with a planned Power Usage Effectiveness (PUE) of 1.4 for its expansion projects, with the upcoming Johor facility, developed in collaboration with Singtel’s Nxera, targeting even lower PUE. Technologies such as intelligent cooling systems, solar panels and energy-efficient servers further reduce environmental impact and operational costs, ensuring TM’s growth aligns with global sustainability objectives. TM’s commitment to sustainable practices was recognised at multiple awards in 2024, including the Gold Award for its Smart Forestry AI tool under the Environment & Natural Resources Sub-Category: Climate Change Mitigation and Adaptation in the MTE 2024 SDG International Innovation Awards. This recognition affirms the Group’s leadership in sustainability, aligned with Malaysia’s environmental goals and net-zero ambitions. “We believe sustainability is fundamental, not just an afterthought. Our goal is to grow responsibly, delivering technology that benefits both the economy and the environment,” said Amar. Strategic Execution for Long-term Value Creation 2024 marked the first full year of implementation of its PWR 2030 strategy, which is the Group’s roadmap to becoming a Digital Powerhouse by 2030 and positioning Malaysia as the digital hub for ASEAN. “This phase is about solidifying our foundation to protect the existing core business to better position us in capitalising emerging opportunities such as hyperconnected data centres, AI and GPU-as-a-Service which are among the new growth areas for TM,” said Amar. During the year, TM made significant progress in strengthening its core businesses across B2B, B2C and C2C amidst intensified market competition. Key milestones include strengthening the convergence proposition, advancing digital solutions such as smart services, cloud, cybersecurity, as well as enhancing digital infrastructure such as domestic fibre network, mobile backhaul to support 5G, submarine cable systems and data centres. These strategic developments reinforce TM’s commitment to advancing Malaysia’s digital future while uplifting the broader ecosystem, with Warga TM continuing to be the driving force behind the Group’s growth and success. As TM continues its journey, the Group remains focused on delivering long-term value creation while creating meaningful impact for the nation. “TM is not merely a provider of technological infrastructure, but as an essential enabler and catalyst for a vibrant digital ecosystem, connecting Malaysia to the world and the world to Malaysia. As we move forward into the next phase of our journey, every initiative we undertake moves us closer to becoming a Digital Powerhouse by 2030, one that drives national progress, fosters innovation and ensures Malaysia remains at the forefront of the global digital economy,” said Amar, concluding his presentation at the TM’s 40th AGM.

Tune Protect enters partnership with Huawei Malaysia and TM

FIRST TO HOST THE INSURANCE CORE SYSTEM ON TM’S PUBLIC CLOUD IN MALAYSIA Tune Protect Malaysia (Tune Protect), Huawei Technologies (Malaysia) Sdn Bhd (Huawei Malaysia) and Telekom Malaysia Bhd (TM) announced a collaboration today for Tune Protect to re-platform its existing GIS (General Insurance System), an insurance core system on Cloud. The hosting of Tune Protect’s core insurance system on Cloud is the first for insurers in Malaysia as it progresses in its digital transformation. The core system comes with a set of SAP HANA and SAP applications that will be completely hosted in TM Cloud αEdge (pronounced as Cloud Alpha Edge) which provides multi-cloud deployment management platform, scalability reliance and trust . This pivotal move is part of Tune Protect’s Cloud First strategy , and in line with current market demand. Works are currently underway for the core insurance system to be deployed in multiple phases commencing July 2022. Rohit Nambiar, Group Chief Executive Officer of Tune Protect said, “As the first insurer to have received the approval to host the core system on Cloud, we are further enhancing our group credentials. Cloud is the centrepiece of our digital transformation that will enable us to achieve speed-to-market and introduce more innovative products and services for our customers.” TM Cloud αEdge plays an important role as digital platform enabler through the offerings of comprehensive set of cloud services in Malaysia and will transform Tune Protect’s existing business capabilities and services into a highly scalable, and agile cloud native open standard and platform to unlock its existing capabilities into unlimited digital value. This transformation is crucial to support today’s fast-paced and demanding business operations and ensure the company consistently stays competitive in the market. Partnering with Huawei Malaysia and TM has brought Tune Protect to a whole new level of engagement experience. Aside to providing cloud and digital services, Huawei and TM have also demonstrated teamwork and commitment through the rendering of advisory and consultation in terms of compliance and technical requirements that align to the guidance provided by Bank Negara Malaysia (BNM). This will be the first core insurance system in Malaysia that has been officially approved by BNM and will be hosted on TM Cloud αEdge -- the only Malaysian-owned Hyperscaler Public Cloud, that primarily promotes data sovereignty. This marks a significant milestone for the company as TM’s Cloud αEdge meets the data protection standard and compliant to BNM’s Risk Management in Technology (RMiT) full guidance requirements checklist, making it the ONLY Public Cloud choice for financial service industry (FSI) customers’ cloud adoption in Malaysia. Meanwhile, Imri Mokhtar, Group Chief Executive Officer of TM said, “We fully understand the importance for FSI customers, including insurers such as Tune Protect to have highly secured digital infrastructure while they continue accelerating their digital adoption. Given the rising volume of digital transactions and our commitment to excellent customer experience, we must ensure that the infrastructure supporting our partner is resilient, scalable and protected on all fronts. With TM Cloud α Edge being fully compliant to BNM’s RMiT, FSI players can reap the benefit of scalability and agility to future-proof their business, while simultaneously protecting customer data, at a superior price advantage. Through our enterprise and public sector business solutions arm, TM ONE, we are ready to serve the industry with end-to-end robust and secured digital infrastructure, befitting our role as the sole Malaysian Cloud Service Provider (CSP) under the MyDIGITAL initiative.” In conveying his appreciation and support for this collaboration, Huawei Malaysia’s Vice President of the Cloud and AI Business Group, Mr Lim Chee Siong said, “It is always our goal at Huawei Cloud to dive into digitalisation and to provide everything as a service. Huawei will continue to innovate and team up with TM and our partners to dive into digital and build the cloud foundation for an intelligent world. Cloud is just the beginning. We view it as a runway to transport businesses to even greater heights.” TM is the only local player with its own core Data Centre and Cloud infrastructure with full data residency, locality and sovereignty. Through the collaboration with Huawei Malaysia, this infrastructure is reinforced through Cloud, AI and the most advanced cybersecurity practices and technologies, putting it right on track to become the only Malaysian-owned end-to-end Cloud AI infrastructure service provider. This means the data in the Cloud is stored right here in Malaysia instead of abroad, providing a solution to the challenge of data sovereignty.